Singles’ Day began in 2009 as a way to goose Alibaba’s sales. In the decade since, it has grown to become a frenetic and flashy celebration of the empire Jack Ma built. This week, that party got rained on.

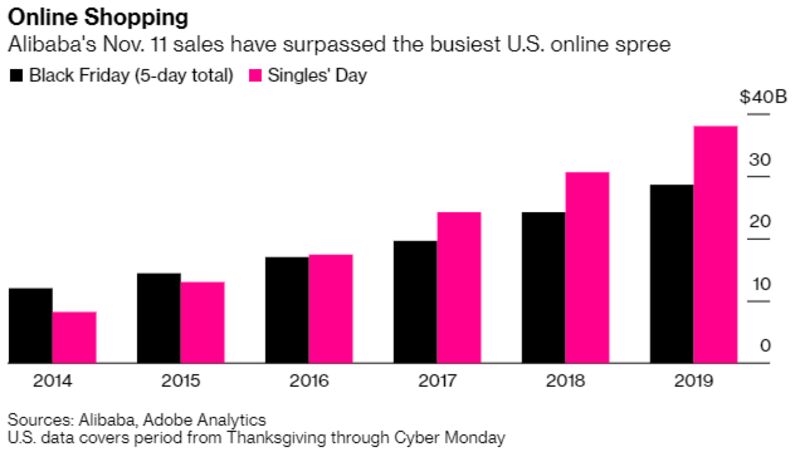

The festivities observed annually on Nov. 11 went on as usual, albeit scaled back because of the pandemic, and saw sales climb to $75 billion, easily surpassing the $38 billion haul from 2019. Unfortunately for Alibaba, events the day before overshadowed the shopping bonanza.

Beijing on Nov. 10 unveiled a sweeping proposal to root out monopolistic practices in the internet sector, precipitating a sharp selloff in shares of Alibaba and its peers.

That regulatory squeeze will of course affect more than Alibaba. Tencent and its ubiquitous WeChat app are an obvious example. But even compared to a firm as large as Tencent, Jack Ma’s empire is exceptional for its size and sway. After all, it was not that long ago that Ma’s Ant Group was preparing a $35 billion IPO.

For Beijing, it is a momentous pivot. While Chinese policy makers have yet to publicly elaborate on why they’ve decided to clamp down on some of China’s brightest corporate stars, a few observations can be discerned.

Big tech is under scrutiny around the world. On the same day China unveiled its plans to tackle monopolistic behavior, the European Union said Amazon is likely breaching antitrust rules. That was after the U.S. Justice Department sued Alphabet Inc.’s Google last month, accusing it of abusing its monopoly in search.

It also appears that as China’s economic recovery from the pandemic stabilizes, regulators are shifting their focus to controlling risk from promoting growth. After halting Ant’s IPO last week, regulators this week continued to pledge a crackdown on abuses in fintech. And while the U.S. and Europe are discussing additional stimulus, China’s central bank has begun talking about exiting its Covid-related easing policies.

Finally, it is worth noting that top Communist Party officials just last month endorsed President Xi Jinping’s plan to make innovation and tech self-sufficiency the cornerstones of Chinese policy for the foreseeable future.

Viewed in that context, it’s hard to imagine these anti-monopoly rules would have been proposed if Beijing thought they would undermine innovation. It would seem much more likely that officials view reducing abuses as a way to encourage it.

For China’s tech billionaires, the regulatory landscape is changing fast. It’s no wonder the stock market is selling first and asking questions later.

Read More at: Bloomberg